Smarter Systems. Faster Trading.

Bridging AI and quantitative infrastructure to advance institutional trading.

OrixaTech develops advanced financial technology solutions that combine speed, scalability, and research-driven insights. Our products support quantitative funds, family offices, and institutional research teams in building, testing, and executing strategies, keeping the client in full control.

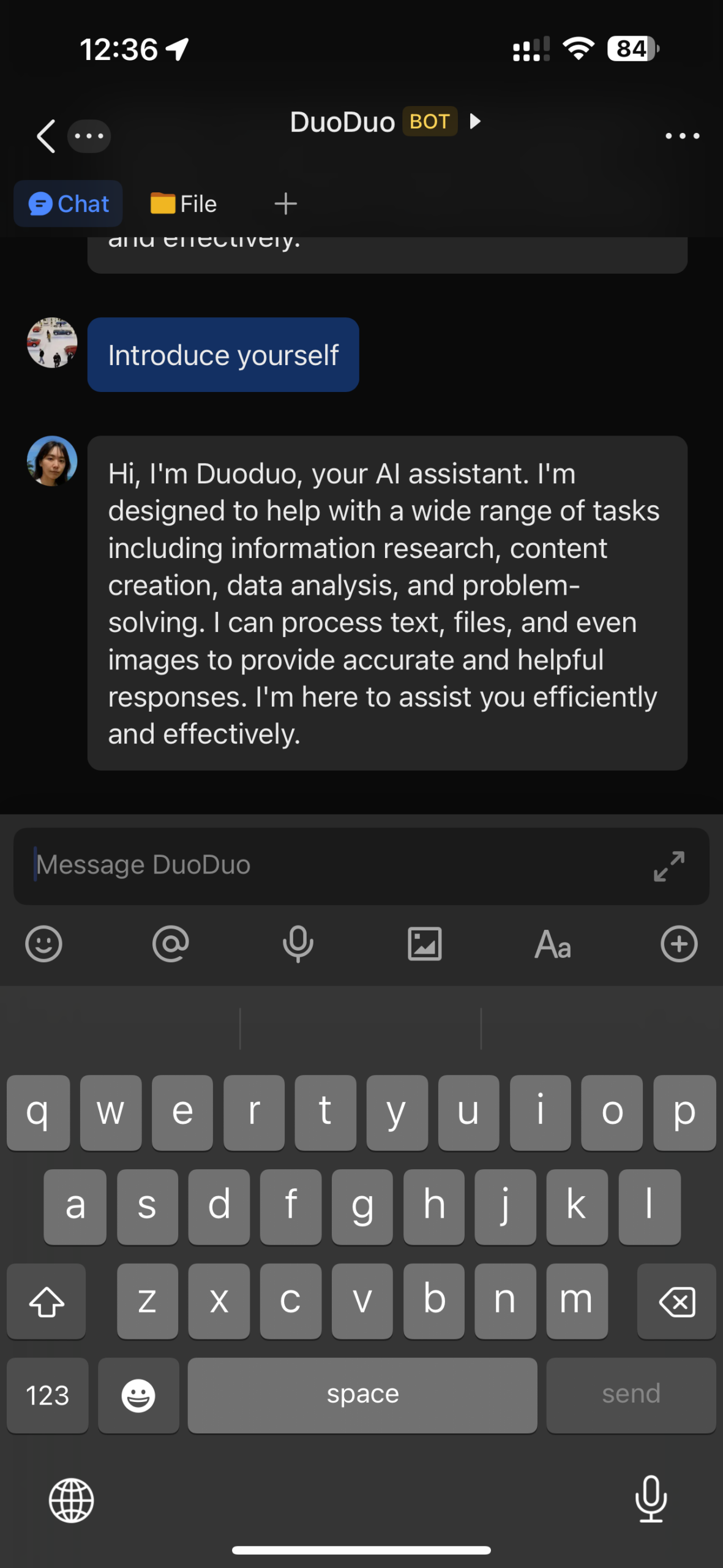

Trading Gateway

Low-latency infrastructure with multi-market connectivity.

Options Trading System

Advanced options management with configurable risk controls.

AI Asset Allocation Model

Model-based research reports for technical and academic use.

AI Agent

Automation for complex financial and research workflows.

100 μs

Ultra-low Latency

Order and cancel response time under 100 μs.

10,000

Ultra-high Throughput

Gateway handles over 10,000 orders per second under peak load.

2018

Proven Reliability

Gateway has been running stably since 2018.

OrixaTech provides technology solutions, not investment advice. All investment decisions remain the responsibility of the client.